Are you wondering if you should accept a structured settlement?

When you win a civil suit or settle out of court, you have a few options to receive your payment. However, you can choose a lump sum payment, or you can choose to receive a structured settlement.

So, what is a structured settlement?

In short, a structured settlement is a type of payment method in which you receive a consistent flow of smaller payments from the larger amount you were awarded.

Although you will receive the full amount of your settlement, it will be paid out over a longer period.

While some people won’t benefit from a structured settlement, many will. You got it right; we will discuss the whereabouts of the structural settlement.

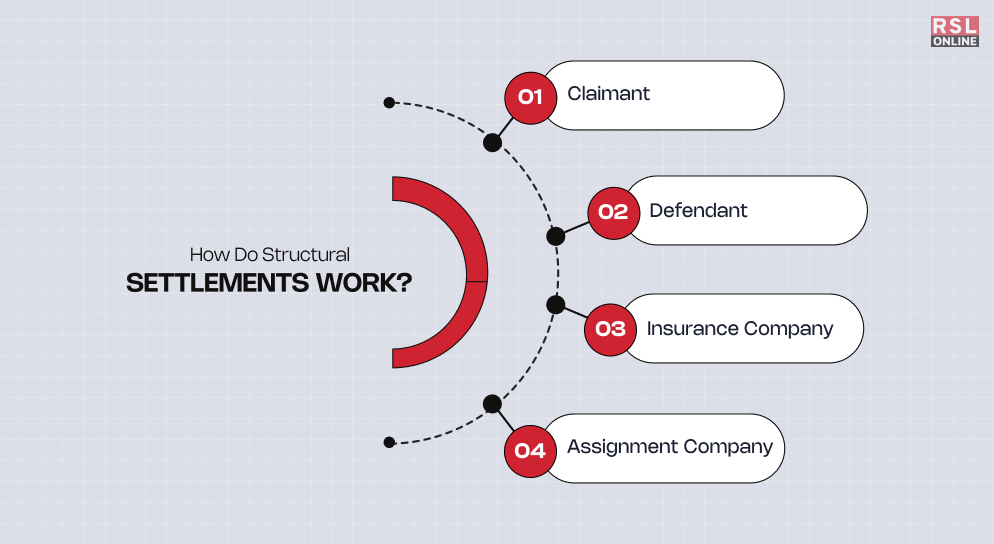

How Do Structural Settlements Work?

Structural settlements are the results of the legal settlement that one receives through the insurance companies. However, we discussed how structural settlement functions.

Usually, four parties are involved in a structural settlement: the defendant, claimant, insurance company, and assignment company.

Claimant

The claimant is the party that the claimant sues. The court discusses with the claimant if they win against the defendant. They may go for the structural settlement.

Defendant

The next key party involved in structural settlement is the defendant. If the defendant loses the case in court, then they may have to set up a structural settlement.

Insurance Company

The assignment usually involves working with life insurance companies. They buy structural settlement from the life insurance company. In addition, they are the ones that issue payment to the claimant for the contract of the annuity.

Assignment Company

Another important stakeholder in this process is the assignment company.

The defendant, who tries to evade the payment, or the insurance company enters into an agreement with the claimant.

It is on settling the periodic payment options. The obligation is then transferred to the company that takes on this very obligation. To understand “what is a structured settlement?” You must have a clear idea of these interest groups.

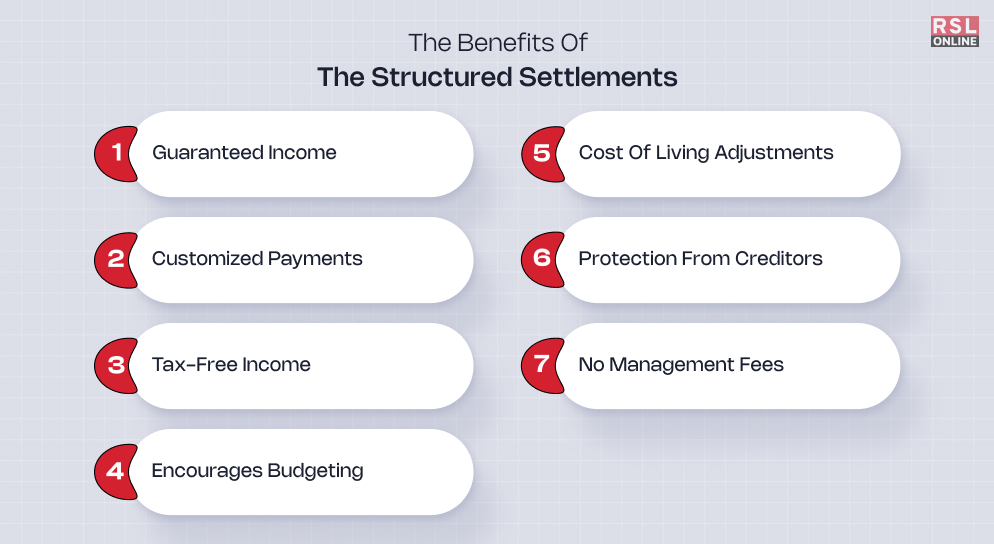

The Benefits Of The Structured Settlements

The structured settlements best suit different types of cases. Although these payments offer several advantages, it is important to comprehend both the benefits and the risks.

However, the stakeholders, while setting the payment mechanism for structured settlements, decide that the injured parties should be encouraged to receive the payments periodically over time.

If there is quite a voluminous payment settlement, the interests would be subject to taxes.

If you are deciding how you want to receive your payment, here are several benefits of structured payments you need to consider.

Guaranteed Income

One of the best benefits of a structured settlement is the guarantee of income. Depending on the amount of your settlement, you can have regular payments for the rest of your life. Consequently, this can reduce financial stress and give you financial stability.

Customized Payments

A great benefit of a structured settlement is customized payments. If you experience a financial emergency, you can customize several payments to provide financial relief. If you are experiencing financial struggles, visit https://www.rightwayfunding.com/for your options.

Tax-Free Income

Many lump sum payments come with a series of tax fees that can dramatically reduce how much money you receive. Fortunately, structured payments are tax-free, including the interest, principal, and more.

Encourages Budgeting

Perhaps the most important benefit of a structured payment is money management.

By receiving your settlement in a series of small payments, you can avoid spending the bulk of your settlement at once. This can result in long-term financial stability.

Cost of Living Adjustments

Although your structured settlement will start at a certain payment amount, over time that amount will increase.

This is because the payments are automatically adjusted to account for your current cost of living.

Protection From Creditors

If you owe money to creditors, the good news is, that they cannot come after your structured settlements.

This is because a settlement is considered a policy, instead of an asset. Protection from creditors is ideal for those who are in debt and don’t want to lose their settlement.

No Management Fees

Unlike many investments, structured settlements do not have any management fees attached.

You will not have to pay attorney fees, expenses, commissions, and more.

This Is What a Structured Settlement Is and How It Can Benefit You

By reading this guide, you can understand what a structured settlement is and several ways it can benefit you.

Structured settlements offer many benefits, including guaranteed income that is tax-free. You can customize your payments, request cost-of-living adjustments, and avoid management fees.

Best of all, structured payments protect you from creditors and help you manage your settlement wisely.

These are some of the many benefits of structured settlements.

Don’t forget to browse our site for advice on business, products, services, and more.

Additional Reading: