As the new space race is gaining ground, numerous space startups also appear to grab a piece of the global space cake. There are various talented engineers, innovative technologies, and hard-working teams dreaming about changing the world with the help of space technology. But the main obstacle on the way to success is financing.

Well, there’s a reason we call it ‘rocket science’, so it’s not that easy to convince investors from large venture funds, such as Noosphere Ventures, Funders Fund, and many others, that your rocket, satellite, or whatever you’re working on is not mature. And it’s a considerable risk for investors, too.

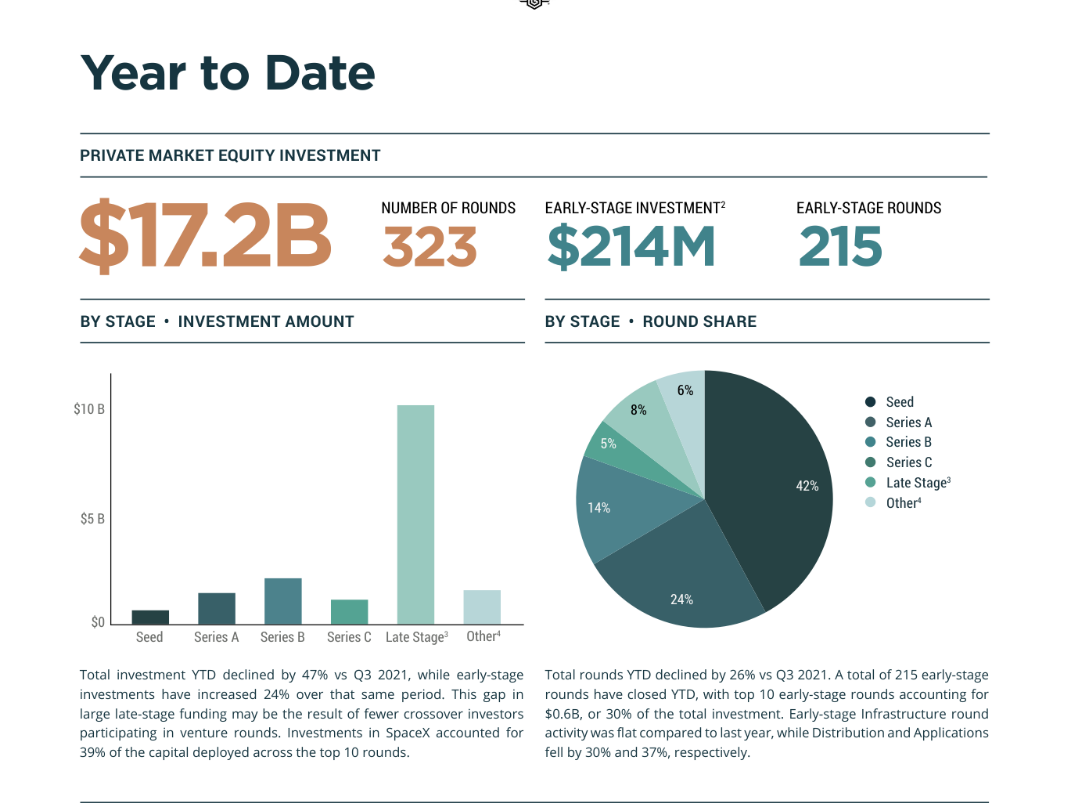

Space companies usually require a lot more funds than software companies working on other fitness apps. Still, in 2021 venture capital firms poured a record-breaking $17.2 billion, according to the report by Space Capital.

Let’s take a closer look at some of the venture funds actively investing in space technology – Space Angels Network, Founders Fund, Noosphere Ventures, AE Industrial Partners, and Seraphim.

Details About Investment Funds In The Space Industry

1. Space Capital LP (Parent Brand Of Space Angels)

Space Capital is the most prominent venture fund that is investing in the space sector. It was founded in 2017 in New York City, and the firm launched its first fund of $16 million the same year.

CBInsights mentioned that Space Angels has provided funding to 24 firms and deployed more than $126M during 2010-2017. They are the most active investors in the space sector, mainly focusing on early-stage ventures. Its portfolio companies include ICEYE, GHGSat, Isotropic, LeoLabs, and Skywatch.

Read Also: How To Launch A Space Career

2. Founders Fund

Founders Fund is another influential investor in the space sector. Launched back in 2005, the venture fund managed over $11 billion in total assets as of 2022. They primarily invest in businesses across all stages.

Besides space tech, the fund also invests in consumer Internet, advanced computing, energy, and other sectors. Founders Fund was the first institutional investor in SpaceX. Their portfolio includes companies like Accion Systems, Planet Labs, and Moon Express.

3. Seraphim

Seraphim Capital is a UK-based venture capital fund created in 2006. They invest in early-stage, late-stage, series A, seed, series D, and Series C rounds. The fund is most interested in business ideas that offer a kind of fusion of space technology and terrestrial applications. The companies in their portfolio include D-Orbit, PlanetWatchers, LeoLabs, Bamboo Systems, ICEYE, and Altitude Angel.

4. Noosphere Ventures

As for Noosphere Ventures, it was founded by Max Polyakov. This international asset management firm with US-based headquarters primarily focuses on new space ideas. Fund’s managing partner, Max Polyakov, founded and acts as an advisor at a number of global companies.

Noosphere Venture Partners’s portfolio of space companies includes EOS Data Analytics, which expects the launch of its first satellite by the end of 2022, electric propulsions developer Space Electric Thruster Systems (SETS), and logistics company for space D-Orbit. It also invested in Firefly Aerospace which had recently committed its second successful test launch into orbit.

5. AE Industrial Partners

Founded in 1988, AE (AeroEquity) Industrial Partners is a private investment firm focused on the aerospace and power generation sectors. The company’s portfolio has been recently enhanced with the acquisition of Noosphere Ventures’s stake in Firefly Aerospace, the US-based rocket company.

They purchased the shares from Max Polyakov, who brought the company back to life after it went bankrupt. AE Industrial Partners also invested in other aerospace companies, such as Redwire Space, Sierra Space, Belcan, American Pacific, and Kellstrom Aerospace.

6. Will The Space Boom Last Long?

While it’s hard to predict how long space ventures will pour money into new space startups, we can surely say that the market is a bit overcrowded today. As the space race becomes more intensive and the expectations are high, not all space companies will survive. Not many VC funds anymore want to invest in low or long-term profitability models.

So, we can expect a reduced level of early-stage investments and a slowdown of the investment race. Still, firms like Space Capital, Seraphim, or Noosphere Ventures will surely be on top, owning the companies which have proved to be efficient and profitable assets.

Read Also:

- How to Get Started on a Different Career

- Everything You Need To Know About Building A Career As A DJ

- Is Fashion Management Course In India A Good Career To Take Up In 2022?