Getting credit to start one’s own business has its challenges, especially if you need a credit history or a poor credit score. But now you do not have to be too bothered. Some business credit cards do not require a credit check. They help you access the finances you need to start your own business.

In addition, the top startup business credit cards with no credit have many benefits, propelling individual endeavors to become successful.

-Are you looking to embark on a new business journey?

-Searching for fund sources?

This study discusses top startup business credit cards with no credit. So, let’s get started with the discussion.

How Does Startup Business Credit Cards With No Credit Check Works?

This section is mainly for people who do not have prior experience with it. Before opting for it, you need to know how startup business credit cards actually work.

When you apply for a startup business credit card that does not require a credit check, your application goes through diverse considerations, such as business revenue generation and credit history. But with this credit card you can access the funds even if you have a bad credit score.

The application process is much more straightforward than that of traditional credit cards. Once the lenders approve your loan, you can use your card immediately up to the specific credit limit. This is how the lending mechanism works.

Looking at the simplicity, you will find hundreds of business owners searching for startup business credit cards with bad credit, credit cards for students, and others to access the required funds. Yes, this is how the startup business credit cards with no credit function.

Small Business Credit Cards With No Credit: Major Variants

Some credit cards are available to you when you are looking for startup business credit cards with no credit. Why don’t we go through the list that I am creating for you which will help you identify the right credit cards especially if you are looking for no credit?

Corporate Credit Cards

This is one of the most effective startup business credit cards with no credit variants suitable mainly for larger companies.

Corporate credit cards differ from other small business credit cards because the liability falls directly on the business entity instead of the business owner.

Traditional Business Credit Cards

If you are a new beginner looking to apply for a low-rate credit card, this one is mainly for you. What you need to research is the different issuers of small business loans. Know that the average startup capital requirement for a small business owner is $ 10,000.

Secured Credit Cards

The secured credit card is the last variant of the startup business credit cards with no credit.

These credit cards are handy for new business initiatives.

A secured credit card requires a deposit, which acts as the collateral to bring down the risk to the lenders. Yes, your credit limit generally equals what you can put down as a deposit. These credit cards can help build your business credit.

Top 10 Small Business Credit Cards With No Credit?

If you are looking for a business credit card with zero credit history, you can select from among the aforementioned types we mentioned.

For instance, you have selected from among the most creative AI business ideas and want to proceed with them.

Yes, this is the age of A.I. Not only are new growth opportunities cropping up, around 61% of firms plan to hire professionals with A.I. experience, and around 80% of the founders feel that A.I. will grow continuously in the coming years. New business ideas need investment.

However, most of the time, they are available, don’t worry.

But can you select any small business credit card randomly?

Yes, selecting the right one is important.

It would be a costly mistake to make. This is why we discuss the top 10 business credit cards with no credit. So, let’s get straight into the topic.

1. Bill Divvy Corporate Card

The registered business can use these corporate cards with the help of an EIN and a U.S. business bank account.

Moreover, the startup credit card with no credit comes with expense management software. In addition, you get point-based rewards with bonus points in different categories.

However, you need only a soft credit check to get the cards, which would not affect your credit score.

In addition to this, you need a lower capital requirement of $20,000. However, the best benefit is that you do not require an annual fee.

2. Open Sky Secured Visa Credit Card

This is a unique startup business credit cards with no credit no deposit. One requires a refundable security deposit in lieu of a credit check.

This card is excellent for new business startups. Another key advantage that you reap with the help of these cards is that you do not need the hurdles of traditional credit checks. Hence do, apply for a low rate credit card like this.

The security deposit associated with these cards helps mitigate the issuer’s risks and ensures approval. We rank them among the top startup business credit cards with bad and no credit.

3. The Ink Business Unlimited Credit Card

When searching for this very credit card, you can bank on it. Yes, this credit card would be highly effective for the new beginners.

Hey, why not start your business right away from home?

Yes, there are diverse benefits associated with home-based small businesses. Over 80% of business owners operate without any staff. This is the benefit associated with the very business. But what about money?

Ink Business Unlimited credit cards can help you out. The simplicity of the reward structure is the added advantage that you have with this card.

Why would anyone not take it and get benefits like 1.5% cash back on the purchases? Finally, the lack of annual fees makes this very credit card a highly cost-effective option for startups aiming to stretch their monetary resources.

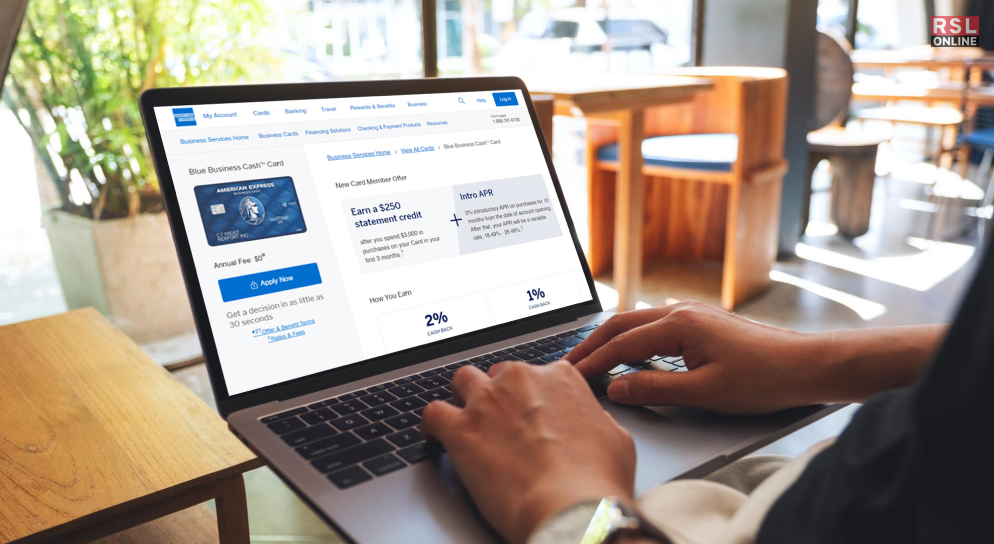

4. The American Business Blue Business Cash Card

This is a major startup business credit card with no credit, and it is ideally suited for new entrepreneurs who begin their business investment journey by spending below $50,000.

This card offers a cashback of 2% on up to $50,000 yearly. Thereafter in the following years, it offers cashback of 1%.

Another key feature that you can see in this card is the expanding power of buying. Probably the best feature the American Express credit card offers is the flexibility of enterprises to spend beyond the limits of credit.

5. Nav Prime Card

The Nav Prime card is a charged card. It means you don’t get any rewards. The main purpose of this card is to assist small business owners build business credit.

Each transaction that is made with the help of the card gets reported to the credit business bureau. The very card emphasizes quite a lot the credit health of the borrower. Besides it tracks business credit history.

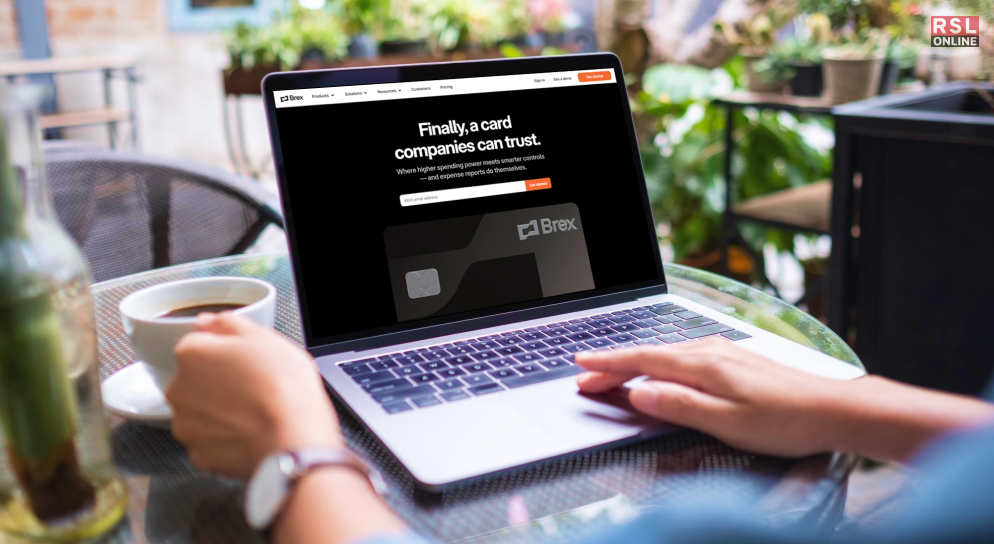

6. Brex Card

The Brex credit card is meant mainly for businesses that fall under the mid-market company.

With this startup business credit cards with no credit, you do not need a personal credit check guarantee. Moreover, you can focus on the financial health backing of the company. With this card, you get many expense management features. This would make it easier for the startups to manage and categorize their expenses.

These benefits that new entrepreneurs highly seek after the card offer quite strong investor support.

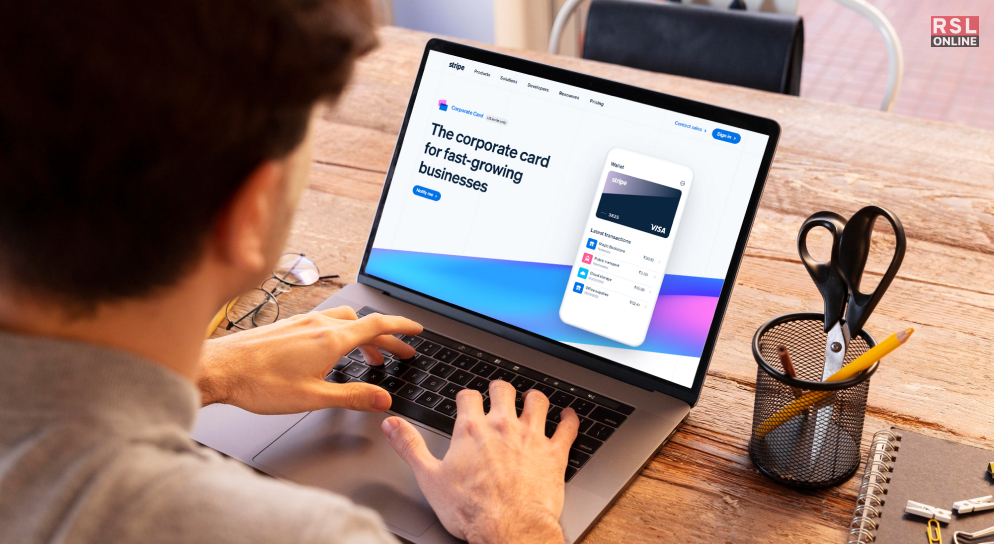

7. Stripe Corporate Card

It is one of the best startup business credit cards with no credit, (with no credit check). You do not need a personal guarantee with this credit card. Moreover, you can brand the card with your logo. The card’s other benefits include real-time expense reporting and the ability to set customs spending controls.

The only drawback of the card is that it is available only to US entrepreneurs.

8. Ramp Visa Corporate Cards

This credit card is suitable for businesses with employees. According to a study, startup businesses operating in the US have an average of 10 employees.

Hence, small businesses with a minimum workforce or more can benefit immensely with the help of the very card.

Yes, it is one of the cards considered highly helpful for small businesses. However, some other benefits that you reap with the help of credit cards include:

- There are no foreign transaction fees.

- Cashback on the purchases.

- There is No requirement for a personal guarantee.

- No late fees.

9. Capital One Spark Miles For Business: Most Rewarding Business Credit Card With No Credit

As mentioned, the card offers many regards for startups with almost $0 introductory annual fees for the first year. Moreover, you get as much as 2x miles on all the purchases and 5x miles on the hotels and car rentals.

This makes it an attractive option for the business with travel requirements. Yes, the specific travel and purchase protection the cardholders get includes rental car insurance, travel accident insurance, and extended warranty coverage.

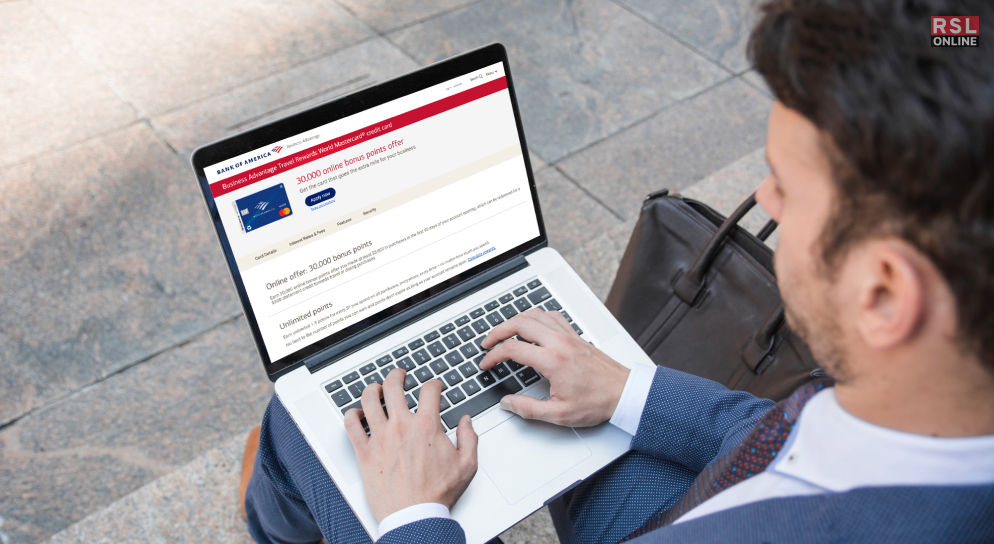

10. Bank Of America Business Advantage Travel Rewards World Mastercard

We have probably kept the best among all that we mentioned and discussed. This business credit card is best suited for a startup that requires traveling. With this credit card, you can maximize your travel expenses. You do not need to incur annual fees.

Moreover, the card offers 1.5x points on purchases, with higher points available through the rewards program. This makes it an attractive option for businesses with different spending habits. The absence of international transaction fees, and flexible redemption options, are among the benefits you get with this card.

Putting The Discussion To A Close

The startup business credit cards with no credit which we brought up in our discussion, are highly beneficial to new business starters. Moreover, they come with their own benefits, making them greatly effective for starting a new business.

Brex Card, Bill Divvy corporate cards, and the others that we mentioned in our discussion may be different in terms of their concept. But the underlying object of it is the same, that is, motivating new business entrepreneurs to board the journey to business success. This is the reason why the popularity of this credit card keeps on increasing with time.

Additional Reading: