A covered call is a strategy that uses options to generate income. It works by buying calls that are expecting the stock price to fall. According to tastytrade, “It is a common strategy that is used to enhance a long stock position.” Many individual investors may also benefit from this conservative options strategy.

A covered call is a two-part strategy in which the stock you are going to purchase or own. The calls are sold on a share-for-share basis. You are buying the stock and selling them at the time. The term overwrites and describes the covered call strategy.

What Are Covered Calls Exactly?

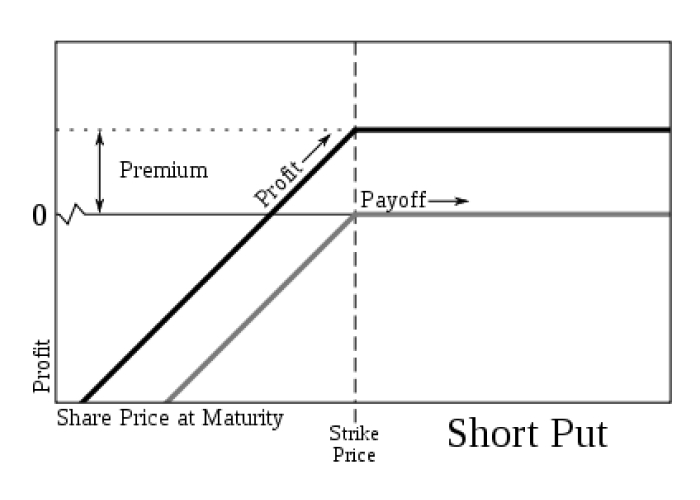

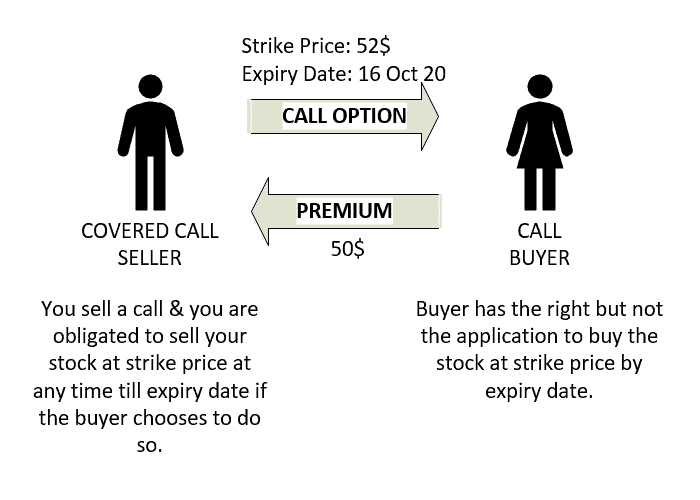

As an owner of a stock or futures contract, you have several rights. One of these is the right to sell the security anytime during the market price for cash. The buyer will gain the right to own your security rights on or before they are supposed to expire. This is what is called a “strike price” in terms of stocks.

A covered call is a type of contract that allows the buyer the right to purchase 100 shares of futures or an underlying stock contract at a set price at any time before it expires. The seller of a call option may choose to buy the underlying security instead of selling it at a lower price, which would result in them not having to pay the full amount.

Advantages Of Proccessining Covered Calls

Selling covered calls mean you are helping offset downside risk and adding to upside return. For example, if a stock closes at $59, the seller would get the cash premium plus the future upside.

Here are the three significant advantages of processing the covered calls.

- Selling the covered calls helps the investors to target the higher selling prices, which is more than the current stock prices.

- The covered calls are getting a limited amount of downside protection.

- The premium of the covered calls is counted as the income and kept.

5 Tips For Improving Covered Call Strategies

Some people get carried away with covered calls and end up cheating themselves out of their money. With stocks yielding less than five percent, it’s good news for investors. This is why covered calls are so popular.

If you are thinking of selling covered calls on a stock that you want to keep, make sure you do not sell them at any price that would be less than their worth. Doing so can lead to you losing the stock, and you would be forced to pay capital gains taxes.

1. Don’t Sell On Good Stocks

Since downside risk is part of the trade, it makes sense that you accept it at the price it is offered. Since calls are typically higher than the implied volatilities, they’ll usually require more than your share of stocks to pay for.

2. Sell Covered Calls “At-The-Money.”

Most people sell At-The-Money covered calls when they fear their stocks will be called away. Instead of buying low, they sell out-of-the-money calls.

3. Sell Calls That Have Shorter Tenor

When you sell long tenor options, the amount you are receiving goes down. Ideally, you should look for options with a few months left before expiration.

4. Don’t Use Covered Calls To “Take Profits.”

The reason why selling a covered call is wrong for profit taking is that it keeps you exposed to potential losses. Taking profits means you are no longer exposed to losses. If you want to make a profit, sell the stock. This strategy will lock in a range of profits.

5. Stay Calm If Covered Calls Stock Drops Suddenly

Many will find themselves tempted to sell call options at the new lower stock price. However, resist this temptation if you don’t want to lose money. If you sold covered calls at a lower price, then suddenly the stock price rises.

Conclusion:

Although covered calls are a great way to reduce your expenses and generate income, they can also be very costly. This strategy can be used with the right stocks. Use covered calls to generate income from contracts or to decrease the cost basis of a futures contract.

Read Also: