A Demat account is the best way to help provide people with the complete opportunity to hold their shares and securities in the digital or electronic format.

It is known as the dematerialized account, which can be ideally accessed by the depository participants in India. It will always help in keeping proper track of all the investments that the individuals will be making into shares, bonds, mutual funds, and several other kinds of related things.

What Is A Demat Account?

Every trader would agree that a Demat account is of utmost necessity. It is a safe and secure means of storing your stocks. This is why having a Demat account is one of the necessities that you need to understand.

Demat account ensures that your stocks and accounts are safe and under lock and key. As a result, these accounts pave the way for safe trading by ensuring the safety of your stocks and other similar holdings.

Now, these demat accounts have evolved. As a result, these accounts come in different shapes and sizes. Traders aimed towards safe and better handling of stocks.

Types Of Demat Account

As for writing this article, demat accounts come in three different variants. All of these variations help people in various ways. Here is a brief rundown of all the different variations of demat accounts that you might come across. Here we go!

- Regular Demat Account: The regular Demat account is the basic Demat account that a person can hold. This account offers all the necessary features that one might need for trading. A regular Demat account needs to do more in terms of advanced security and support for your stocks.

- Repatriable Demat Account: These accounts are specifically designed for people who are living outside the country. This allows people living outside of India or their respective countries to access and trade. The best part is that you are allowed to transfer funds out of India if you desire.

- Non-repatriable Account: The non-repatriable demat account is similar to a repatriable demat account. However, it comes with one little restriction: you will only be able to transfer your assets in India or the country in question.

There are other forms of demat accounts as well. However, there are different variations as well. In fact, as trading is advancing, more and more forms and formats are coming to the forefront.

6 Benefits Of Having A Demat Account

The Demat account will help provide people with a complete opportunity to have access to a digital platform where they can hold the shares with utmost security with proper elimination of the forgery, theft, loss, or damage to the shares in the whole process.

Following are some of the most important benefits of the Demat account:

1. Minimizing The Risk Factors

Demat accounts very well facilitate the elimination of the risk of paper-based share certificates because, with the advancements in technology, everything will be undertaken in the electronic format.

There will be no chance of any kind of paperwork, which could lead to several types of errors or delays in the whole process. With the help of the Demat account, everything will be electronically saved without any kind of problem.

2. Easy Monitoring Process

This particular concept is very convenient as well as easy to undertake so that there is no problem and monitoring of the details can be carried out very successfully.

This aspect will further help in facilitating the swift transfer of shares at the time of trading online. The Demat account supports all the digital monitoring processes. So, when you have a Demat account, you do not have to maintain a record with pen and paper. By only signing into your account, you can see all the transactional details from there.

3. Automatic Updation Process

With the help of the right kind of Demat account, everybody will be able to make sure that bonus and stock split will be automatically updated, and there will be no need to indulge in any kind of hassle in the whole process.

This particular aspect will automatically be updated and reflected in the Demat account so that people can make the right kind of decisions at the right time without any sort of hassle.

4. Different Investment Forms

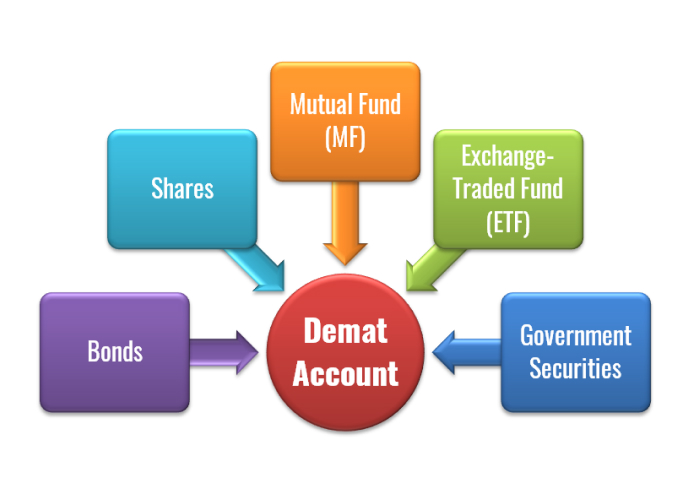

Demat accounts will help in storing different kinds of investments in the form of shares, bonds, mutual funds, exchange-traded funds, government securities, and several other related types of aspects without any kind of problem.

Demat accounts have different investment types and forms so when you want to explore the versatile kinds of structures, which are only possible when you have Demat accounts.

5. Digital Accessibility

The Demat account concept is very much capable of providing people with accessibility at any point in time and from anywhere through the smartphone or laptop without any kind of issue, which eliminates the geographical constraints from the whole process.

While sitting anywhere, you can see all records from your accounts. Only a smartphone and a PC are going to be required to monitor the records.

6. Better Nomination Facility

The Demat account also helps in providing the people with the facility of nomination as per the process described by the repository participant so that shareholding can be dealt with very easily and transferred to the appointed person can be carried out without any kind of comprehensive procedure in the whole process.

Hence, depending upon the Demat account is an excellent idea on behalf of people so that there is no problem and people can ideally use it for different kinds of purposes.

Conclusion:

The best benefit is that it has been perfectly governed by the National Securities depository Ltd, which will be sending alert messages and emails for notifications and transactions performed, which will be a clear-cut symbol of safety and security in the whole process.

Hence, depending on companies like paisa in this industry an excellent approach to avail all the above-mentioned advantages very easily. However, if you liked this article, then drop us feedback, as it will enable us to serve you better.

Read Also: