Starting and running a business is tough enough. But it can get tougher without proper funding. Lack of financing is one of the top reasons why most small businesses go belly up.

Cash is king when floating a startup through the ebbs and flows of the sales cycles.

Getting small business loans from banks or credit unions can be difficult.

Most lenders won’t approve you for a business loan unless you can show a solid trading history and substantial business revenues.

To navigate the challenge, small business owners resort to using personal loans for business purposes.

But is it a good idea? We’ll tell you here the pros and cons of using this personal loan for business.

What are Personal Loans for Business

A personal loan for business is a loan amount that an individual can take from banks. They can use this loan for business purposes. Many use these loans and pump them into their business.

Its prevalence has increased with time. The personal loans for business are laden with benefits, which we have discussed categorically below.

An individual uses personal loans to support their business decisions. One can also use these personal loans for business purposes to consolidate existing debt.

They are easy to access quickly. However, let us look at the following aspects to clear any doubts about the subject.

What Can Personal Loans Be Used For?

This form of financing is a one-time lump sum borrowed from a lender for personal use.

You can use the money for anything as long as your lender doesn’t impose restrictions on using the loan. Thus, technically, you could use it for business purposes.

If you face hurdles in obtaining a small business loan, you can inject cash into your startup through any cash source you find.

And the good thing is most personal loans are unsecured and don’t require collateral. If you’ve got an excellent credit score and stable income, you won’t find any hurdles in obtaining funds.

Other common uses of loans include funding home improvement projects and consolidating debts. You can also use it for a family vacation, wedding, medical expenses, or other purposes.

Personal Loan For Business: Pros and Cons

Everything in this world has its pros and cons. It is definitely not an exception for business personal loans for business.

However, let us understand some of the pros and cons of personal loans. So, let’s look at them here to get a better understanding of the subject.

Pros Of Personal Loan For Business

First, start with the advantages that you have with a personal loan for business purposes.

Flexibility

Whether you want to use the loan to purchase inventory, new equipment, office supplies, marketing campaigns, or as working capital, you’re at liberty to use the money the way you want.

Low APRs

As long as you have an excellent credit score and stable income, you can qualify for a loan at lower APRs than most business loans or credit cards.

Easier to Qualify

It’s easier to qualify for a person than a business loan if your business doesn’t have a solid trading history or substantial revenues. Again, most personal loans are unsecured and don’t require collateral.

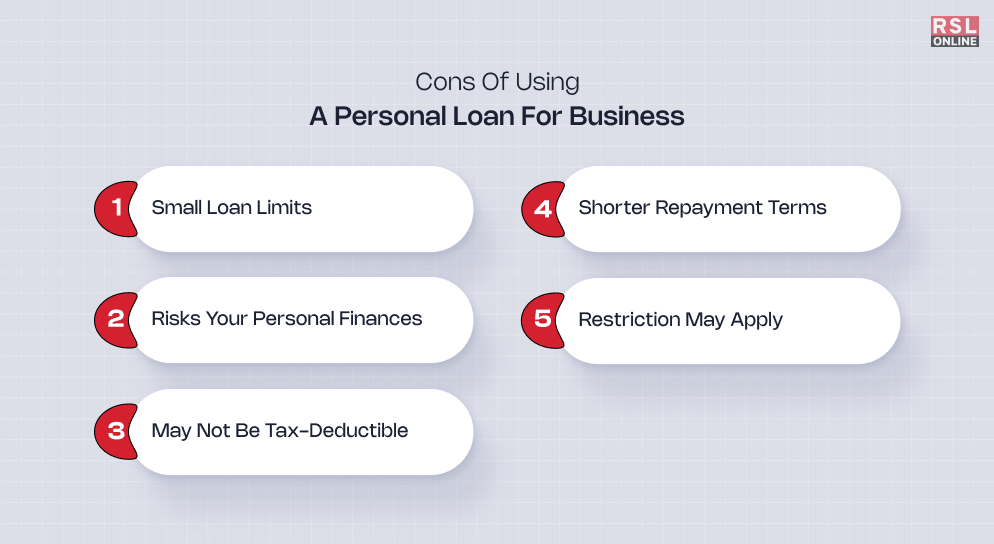

Cons Of Using A Personal Loan for Business

Like every other thing in this world, personal loans have their negative points. Let us understand them too, alongside the pros.

Small Loan Limits

You can only obtain up to $50,000. This is a small amount compared to the $ 5 million limit for business loans.

Risks Your Personal Finances

It’s a good idea to separate your finances from your business revenues. Failure to pay an unsecured loan as required will damage your credit score and make it harder to obtain funding in the future. You can also lose your own assets like savings, a car, or a home in a secured loan.

May Not Be Tax-Deductible

Unlike the interest paid on business loans, interest paid on personal loans doesn’t enjoy tax breaks unless you can prove that you used the full amount of the loan to fund business expenses.

Shorter Repayment Terms

Personal loans should be repaid in one to seven years. Traditional business loans have repayment terms of up to 25 years

Restriction May Apply

Some lenders stipulate what money can or can’t be used for. Some may restrict the use of personal loans for business or academic purposes. Scrutinize the loan’s fine print and understand the lender’s conditions.

Should You Use a Personal Loan for Business Purposes?

You may not get enough money to fund your business operations with a personal loan due to low loan limits. Again, it won’t help you build your business credit. You’re better off using a business loan that is designed to boost a company’s operation.

Read Also:

- Download Facebook Social Toolkit Free Latest Version

- Top 7 Best Home Cheese Slicers In 2021 – Have A Look!

- Com.Facebook.Katana: All You Have To Know About It