The basic distinguishing factor between humans and animals is the ability to reason.

Because of this ability to reason logically, humans can plan ahead. There is an idea, “If you fail to plan, you plan to fail”. For this reason, encouragement drives people to prepare and plan for activities. They hope to participate in or receive the benefits of investing in a gold ira.

One of the areas where people make planning and preparations is towards securing the future.

People do it (especially those of a certain age bracket) who want to ensure that they have financial security. Even people reap the benefits of investing in a gold IRA after retirement. For this reason, people invest to reap the benefits of investing in gold ira and precious metals.

What Is a Gold IRA And Precious Metals Investment?

Generally, the IRA stands for an individual retirement account. As the name suggests, it is basically an individual’s retirement plan that various financial institutions enable.

There are various benefits of investing in gold ira, especially in the area of tax advantages.

Also, there are various arrangements that are obtainable under this plan, one of which is the gold IRA and precious markets investment.

This particular arrangement allows for savings and investments in gold coins and other precious metals.

However, one notes that because of certain peculiarities in this arrangement, it is usually costlier than other arrangements. However, the craze for reaping the benefits of investing in gold IRA remains constant among different age groups.

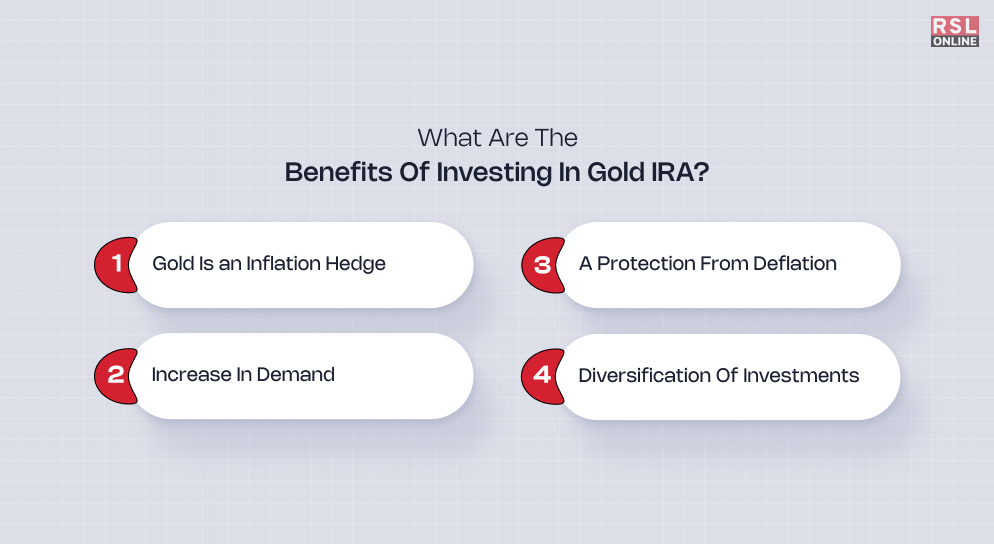

What are the Benefits of Investing in a Gold IRA?

As with any plan, there will always be reasons why it will be attractive to one group of people and why it will be unattractive to others. However, here are some reasons to consider it:

Gold is an Inflation Hedge

inflation and other economic events may affect the value of the fiat currency (say US$). But on the other gold consistently maintains its value; it even increases in value.

Therefore, even though there are permutations by various analysts that inflation might be a problem in the near future, this wouldn’t be the case for you. This is the reason people try to invest and reap the benefits of investing in gold IRAs.

Increase in Demand

In recent times, there has been an increase in demand for gold due to its various uses in the electronic and medical fields.

It is even projected that in the future, its demand will be greater than supply, and there will be a huge demand for it in the market, resulting in a skyrocketing value.

A Protection from Deflation

Just as it is a hedge against inflation, it can also serve as a protection if there is deflation.

Deflation is quite possible, and obviously, the government will print more money to pay off its debt.

However, for its own insurance, the United States government has more gold than any country in the world, and you, too, should protect yourself in the event of a deflation.

Diversification of Investments

Well, this is basically a matter of common sense.

It is a matter of common sense that it is a wise move to diversify your investments and not just put all your eggs in one basket, as the saying goes.

It ensures that whatever happens in the future in one area of your investment, you have other areas to benefit from. You can find out more about this at Click here.

Challenges to Expect in IRA and Precious Metals Investments

It is always important that while entering a new phase or deciding, one is prepared for what that decision or new phase might cause. The following are some challenges to expect:

Expenses

As earlier stated before, setting up the account is costlier than making the normal IRA arrangements. This can prove to be discouraging, especially if you weren’t prepared for it due to a lack of proper orientation.

Theft

Well, yeah, everybody likes gold, and it gets stolen in some instances. But this occurs mostly because of dubious custodians who you might be unfortunate to have run into if you are not or have not researched or prepared for this investment or are just lucky robbers. However, ensure that they are insured.

Choosing Your Representatives

To avoid making mistakes and or running into fraud, you have to take care when choosing your gold IRA company. The following are things that you should do:

Understand This Arrangement

There is hardly any topic in the world today and there are 77 no materials through which people can study and improve their understanding of that topic.

This is even more so in financial matters. Thus, you can do your own research on the topic and even seek professional advice on it. You can visit this metals resource hub for more information that will help you understand the agreement.

Choose Your Custodian (your Gold IRA company)

There are many companies out there looking for customers and people to work with or for as custodians. However, the final decision is yours to make, and these are some of the basic factors to consider before coming to a conclusion.

- The custodian that you choose has to be officially licensed; otherwise, doing otherwise is risky.

- You have to know what their service fees are like before agreeing, or you might get overcharged.

Reap the Benefits of Investing in Gold IRA

Upon retirement, many will not be able to function actively because of age, and unless you have created your own path, you might be left penniless. However, it is important to know that even now, there are options that you can pick from to help yourself.

Gold IRA and precious metals present another opportunity to invest in your future. And if it is done well, you will have reasons to be glad that you did.

Read Also: